How to Read a Credit Report

When it comes to borrowing, your credit history is important to lenders.

Lenders check your credit to evaluate how risky you are as a borrower. Checking your credit allows them to see the types of credit you have, the amount of debt you owe, and how you’ve handled debt in the past.

Lenders don’t expect you to have perfect credit, but they do want to feel confident you will repay them. A credit report helps lenders evaluate a borrower’s likelihood of repayment..

“If the reports and scores indicate elevated credit risk, the consumer may be denied or approved with less advantageous terms. If the reports and scores indicate a low level of credit risk, the consumer will likely be approved with very competitive terms,” says John Ulzheimer, a credit expert, formerly of FICO and Equifax.

Building a good credit rating starts with identifying what is bringing your credit score down. From there, you can put habits into place that build your credit. Therefore, it's essential that you understand how to read your credit report, how to request it, and how to correct any errors.

What is a credit report?

A credit report shows a detailed record of a consumer’s borrowing history. It summarizes a borrower’s track record of managing and repaying debt.

When an individual opens a credit card or takes out a loan, creditors track the borrower’s payment history, loan balance, and credit limit. Creditors then report this information to credit reporting companies. The credit reporting companies compile a borrower’s credit and loan information into a single credit report.

Credit reports may also include bankruptcies and other public records, businesses that have acquired your credit report, and other personal information.

How do you get a copy of your credit report?

Checking your credit report can help you understand what lenders see when you apply for a credit card or loan. Even if you’re not applying for a loan, credit reports are sometimes used by landlords, insurance companies, and employers.

Clearly, if others can ask your permission to pull your credit report, you should be able to access it too. So how do you go about it?

Request a free copy of your credit report by visiting AnnualCreditReport.com. You can view reports from the major credit bureaus: TransUnion, Experian, and Equifax. Consumers can also request access to their credit reports directly from the credit reporting agencies. Typically, borrowers can view their credit report for free once a year.

What’s on my credit report?

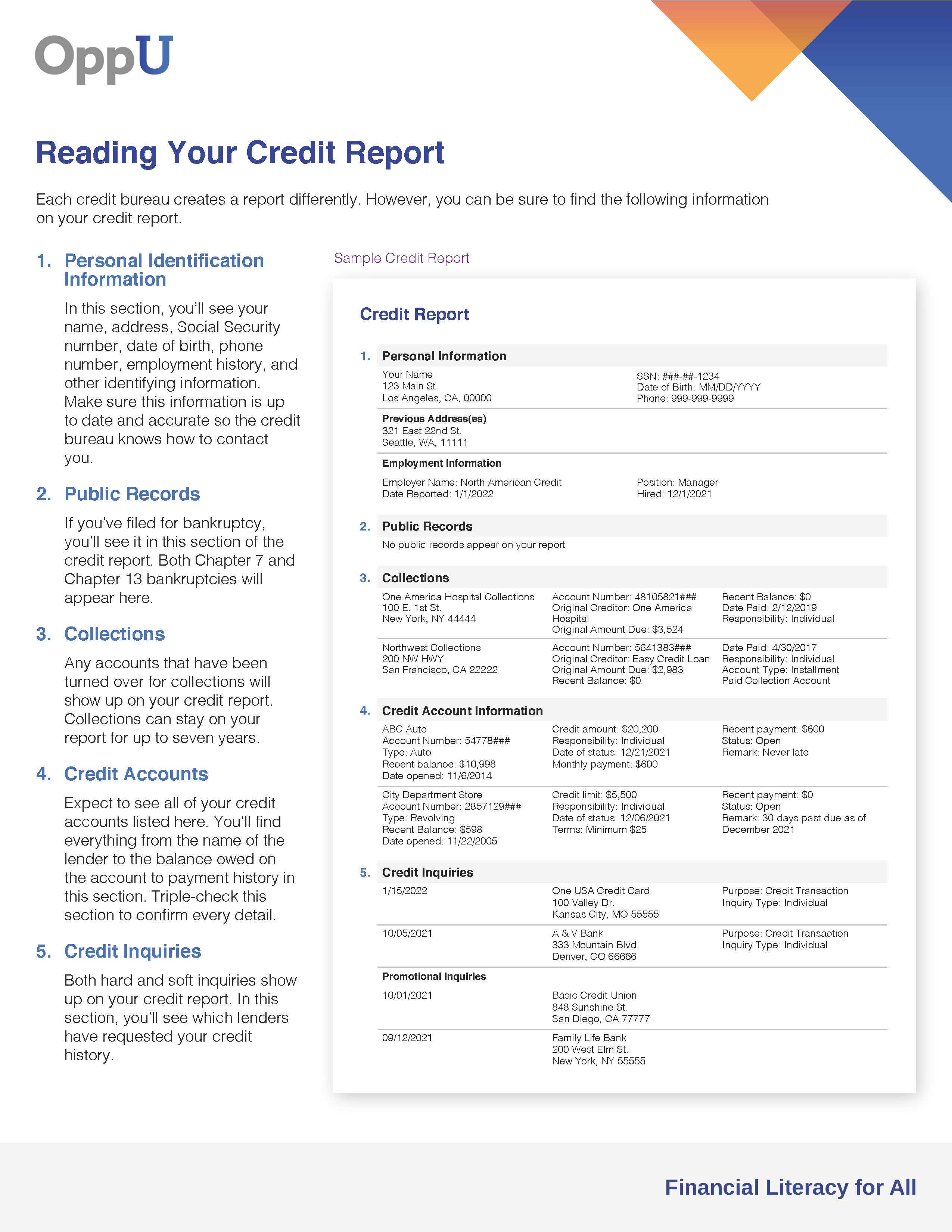

Credit reports differ slightly depending on the credit reporting agency. In general, they share several key categories:

No. 1: Personal identifying information

The first section on your credit report contains personal identifying information. This information should be unique to you and free of typos and misspellings.

The following information is listed in this section:

- Your current and former name(s)

- Social Security number

- Date of birth

- Current and previous address(es)

- Phone number(s)

Sometimes your credit report may also contain your employment history. When applying for credit, some lenders will ask for your employer information in order to confirm your identity and verify your income. If you see your employer or a past employer listed on your credit report, it is likely that a lender gave that information to the credit bureau.

What to check on your report

Your personal information is not used to calculate your credit score, but it can be used to help protect against identity theft. If you see addresses of residences where you never lived or phone numbers you never had, it’s possible someone may be using your information for fraud.

No. 2: Credit accounts

The bulk of your credit report will reflect open and closed accounts, student loans, credit cards, and other types of debt you’ve taken out. It’s here you will see if a lender reported that you missed a payment or paid late.

All accounts, even closed accounts, factor into your credit score. Closed accounts that are in good standing can stay on a credit report for up to 10 years from the close date. Accounts with negative information, meaning the account wasn’t in good standing when the lender closed it, will stay on your report for 7 years.

You can expect to find the following information in this section:

- Types of accounts

- Names of creditors

- Current account balances

- Credit limits

- Loan amounts

- Payment statuses

- Payment history for each account

- The dates when accounts were opened and closed

What to check on your report

While it may be tedious, verify every item in this section of your report, as it’s one of the biggest parts of your credit score. You should recognize every account listed in addition to each balance, payment status, date, and account status. If there are any inaccuracies, file a dispute with the credit bureau that furnished the report.

No. 3: Credit inquiries

Lenders, landlords, and employers may inquire about an individual’s credit for various reasons. Both hard and soft inquiries show up on your credit report.

- Hard inquiries: When you apply for a loan, a lender may pull your credit report, which is considered a hard inquiry. Too many hard inquiries can impact the way lenders view you, as many applications for new credit at once can make a borrower appear risky. Hard inquiries can stay on your credit report for two years. Their impact on your report lessens over time.

- Soft inquiries, such as a credit card issuer sending you an advertisement because you’ve prequalified to apply for a new card, show up here too. Soft inquiries don’t impact your credit score or tarnish your creditworthiness. When you request a copy of your own credit report, it’s considered a soft inquiry.

What to check on your report

If a lender conducted a credit check on you, the name of the lender, date of the inquiry, and their address will appear on your credit report. If you see an unauthorized hard credit inquiry, it could be fraudulent. Contact the lender that performed the credit check for details about the inquiry.

No. 4: Public records

While it’s unlikely you will see a tax lien or other civil judgments on your credit report, foreclosures and bankruptcy are reported in this section.

From the date of filing, Chapter 7 bankruptcy will be on your report for 10 years. Chapter 13 bankruptcy falls off after 7 years, as do other types of negative information on your account, such as collections.

“Any public records or negative items will be the biggest thing to pull your score down,” says Ryan Law, CFP, AFC, and Money Success Center Director at Utah Valley University. “You want to make sure all the information here is correct.”

What to check on your report

Check that negative items have fallen off your credit report when they should have. If a negative item hasn’t dropped off your credit report after the years noted above or an account has incorrectly been listed as in collections, contact the credit bureau or the company that furnished the information that you believe to be incorrect.

Why isn’t my credit score on my credit report?

Federal law entitles individuals to request a copy of their credit report annually; however, it doesn’t compel credit bureaus to calculate a free credit score for you.

Where can I find my credit score?

There are a couple of different ways to find your credit score. It is important to note that the credit score you view may not be the same score or scoring model creditors use, according to the Consumer Financial Protection Bureau.

Credit scores can vary depending on the credit scoring model and the information used to calculate the score. FICO and VantageScore are two popular credit score providers lenders may use.

Here are three places you may find your credit score:

No. 1: Your credit card or loan statement

Many credit card providers give customers a score at the end of their monthly billing cycle. Check a recent statement to find your score.

No. 2: Credit scoring services

Some of these companies may be free or charge a fee to use their services.

No. 3: Credit reporting agencies

Consumers can purchase their score directly from the three major credit reporting bureaus: Equifax, Experian, and TransUnion.

What’s the difference between a credit report and a credit score?

Although they may seem to go together, credit scores and credit reports aren’t the same. A credit report is a summary of information from credit bureaus, and a credit score uses the information on the report and puts it into a credit scoring model to create your score.

3 ways to improve your credit

Hopefully reviewing your credit report helps you gain a better understanding of your financial habits. Remember to look for late or missed payments and high balances, which could be opportunities to build your score.

No. 1: Pay down credit card debt

Paying down debt can lower your credit utilization, which is one of the major determiners of your credit score. Credit utilization refers to the amount of revolving credit you’re using divided by your credit limit. For example, if your credit card balance is $2,000 with a credit card limit of $5,000, your credit utilization ratio would be $2,000 / $5,000, or 40%.

With credit utilization, the lower the better. It’s recommended that an individual’s total credit utilization is no more than 30%.

No. 2: Remove errors from your report

Correcting errors in the accounts section of your credit report is a simple way to see a boost in your score. You may find fraudulent accounts or misreported payments. File a dispute with the credit bureau or the company that furnished the information that you believe to be incorrect to investigate and potentially remove them.

For example, if you recognize a payment mistakenly labeled as late or missed, you can file a dispute to correct the error, which could then improve your score.

“As soon as an error comes off your report, there should be an increase in your score,” Law says. “Credit scores aren’t static. Scores are recalculated and change every day.”

No. 3: Pay on time

Payment history is the most important part of a credit score. While you can't go back in time to fix issues like missed or late payments, you can commit to on-time monthly payments now.

You also want to make sure to pay all your bills on time, not just the ones that show up on your credit report.

“While not everything is reported on your credit report, if an account goes to collections, it can be reported and bring down your score,” Law says.

The longer you pay your bills on time, the better your credit score will become.

How to file a credit dispute

It’s best to address inaccuracies as soon as you see them. An error on your credit report can lower your credit score, leading to higher interest rates and making it harder to obtain credit. In a Consumer Reports study in which Americans were asked to check their credit reports, just over one-third (34%) found at least one error on their reports.

It’s important to note, if you do find an error on your credit reports, contact all three credit bureaus about the error. You should also contact the furnishing party, which is the lender or debt collector that provided the information to the credit bureau.

“If a credit reporting agency refuses to correct an error, it’s likely because the furnishing party is verifying that the information isn’t incorrect,” Ulzheimer says. “In that scenario, it’s best to skip over the credit bureau and deal directly with the furnishing party.”

Individuals can also file a dispute with a credit bureau through the mail, by phone, or online. The Consumer Financial Protection Bureau has an example letter template you can use as a resource. Once you file a dispute, make sure to obtain a fresh copy of the report to verify the file is correct.

To file a dispute, contact the following:

Equifax

Online: equifax.com/personal/credit-report-services/credit-dispute/

By phone: Phone number provided on credit report or (800) 864-2978

Mail: Equifax Information Services, LLC, P.O. Box 740256, Atlanta, GA 30374-0256

Experian

Online: experian.com/disputes/main.html

By phone: Phone number provided on credit report or (888) 397-3742

Mail: Experian, P.O. Box 4500, Allen, TX 75013

Transunion

Online: https://www.transunion.com/credit-disputes/dispute-your-credit

By phone: (800) 916-8800

Mail: TransUnion Consumer Solutions, P.O. Box 2000, Chester, PA, 19016-2000

Understanding your rights when it comes to credit reporting

When it comes to credit reports, consumers have certain federal protections through The Fair Credit Reporting Act (FCRA).

Your rights as a consumer include:

- Knowing if your credit report was used against you

- Having access to your credit score, although you may have to pay for it

- Contesting incorrect or false information on the report

- Putting a security freeze on your report if you’ve been a victim of identity theft

- Opting out of prescreened offers of credit or insurance

If a credit reporting agency does not resolve your dispute after an investigation, consumers have a couple of options. The National Consumer Law Center suggests the following:

- Ask the credit reporting agency to include a note on your file about it.

- Seek legal counsel.

- File complaints with the Consumer Financial Protection Bureau and/or your state Attorney General.

The bottom line

A part of financial hygiene is monitoring your credit. Reviewing your credit reports from all three credit reporting agencies at least annually can help you spot errors that could be lowering your score, and alert you to potential identity theft.

Please note the below article contains links to external sites outside of OppU and Opportunity Financial, LLC. These sources, while vetted, are not affiliated with OppU. If you click on any of the links you will be sent to an external site with different terms and conditions that may differ from OppU’s policies. We recommend you do your own research before engaging in any products or services listed below. OppU is not a subject matter expert, nor does it assume responsibility if you decide to engage with any of these products or services.