Asset monitoring and sustainment

Using sensors, manufacturing automation and control, and unique insight into global datasets to predict and optimise outcomes.

Key contact

Global Business Development Director

Australasia

Business Development Manager

We are trusted partners, assisting with understanding and interpreting data that can help predict and optimise outcomes, increase awareness of the conditions, maintenance requirements, and locations of assets, enhance operational safety, and sustain the life of critical assets. We are trusted to protect high-risk assets and operating environments worldwide, thanks to our exceptional safety record.

Our brilliant people leverage deep industry knowledge and technical expertise to provide consulting for industry and government agencies to support any asset’s design, performance, integrity, and safety concerns.

We are passionate about high performance, and to achieve this, we harness innovation and technological advances to drive operational and sustainability improvement opportunities.

We deliver specialised services such as customised sensor and analytics packages that help sustain your assets’ life and offer vital insights into asset investment and strategy. We enable better operational decision-making, increased availability and efficiency, reduced risks, reduced life-cycle costs, improved emergency response, enhanced security and safety, and reduced environmental impact due to failed or poorly performing assets.

Our vision is for better futures through collaboration and innovation. Our systems deftly weave together data from diverse sources to track and analyse the performance of your assets.

We constantly look to innovate ways in which we monitor, measure, analyse and improve your assets’ performance.

We offer an extensive range of tailored management tools and techniques to help make better decisions about your marine, energy and defence assets.

Are you dealing with complexity? Let’s explore the possibilities. We simulate what could be.

We are world leaders in managing reliability and retaining or restoring your technical assets to the necessary condition when carrying out maintenance.

Our knowledge of subsea logistics, accessibility and reliability enables cost-effective solutions to complex problems.

We provide integrated logistics support across a range of engineering and technical domains to support pre and post-delivery for new or modified ships and submarines.

We offer a range of secure and innovative solutions to help you maximise the benefit from technical information, including the production of user guides, manuals, and asset specifications.

Our design audits help you to improve safety, extend structure and machinery life, verify conformance with specification and identify operational risk.

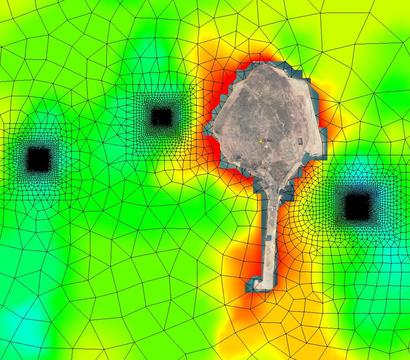

We specialise in the mathematical modelling and simulation of engineering problems, which helps you safely and accurately assess operational issues before implementation.

We have a global reputation for designing bulk materials handling systems that transfer commodities such as coal and iron ore quickly and safely, day in and day out.

We offer tailored risk management solutions designed to align with regulatory framework, applicable standards and client objectives.

We study the risks associated with marine facilities and use our findings to advise on the best ways to mitigate for any potential consequences.

We support the safety of your resources, including setting safety requirements, identifying hazards, assessing risks, ensuring compliance, and providing assurance through the production of safety case artefacts.

In the event of a fire, the impact is often very significant; an in-depth investigation into the origin and cause as well as swift handling of the case is therefore imperative for all parties involved.

Monitoring the condition of assets in harsh environments in real-time.

We provide products, services and solutions through all phases of offshore exploration and production.

Our analysis and guidance at the design stage can help you achieve the best possible performance from your assets.

Our integrity management services help to determine whether assets are operating as designed, reducing potential downtime and minimizing risk.

We cover project management, front end engineering design (FEED), detailed design, construction, and operation, supporting you at every stage.

Our cost-effective, high-quality services help us consistently meet exacting standards in the volatile oil and gas industry.

Handling mined materials in bulk involves high volumes and numerous hazards. Combined with the need to maximise productivity, there is a strong case for using automation and robotics.

We apply engineering technical expertise to various asset integrity assurance and management programs, assisting you in meeting and exceeding industry standards, codes, and regulations.

We evaluate the suitability or interaction of materials to support design, maintenance, and investigations.

We lead welding engineering with a complete range of procedure development, material selection, simulation, testing, and forensic services and provide troubleshooting, production, and code compliance solutions.